$14 an hour 40 hours a week after taxes

14 an hour is 2275 per month. Please note these numbers are exclusive of.

Biden S Minimum Wage Exaggeration Factcheck Org

I work generally about 45-50 hours a week for 1858hr.

. Assuming you work 40 hours a week you would make 560 per week. They essentially mean the same thing just phrased slightly differently. What about each week.

A 14 per hour annual salary is about 29120 provided you work 40 hours a week. The following table shows what an hourly wage earner would make per week for 20 30 40 hour work weeks. On average i bring home 850 after all deductions health insurance alone is 150 a check.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Hourly wage 2500 Daily wage 20000 Scenario 1. 14 an hour is 1050 per 2 weeks.

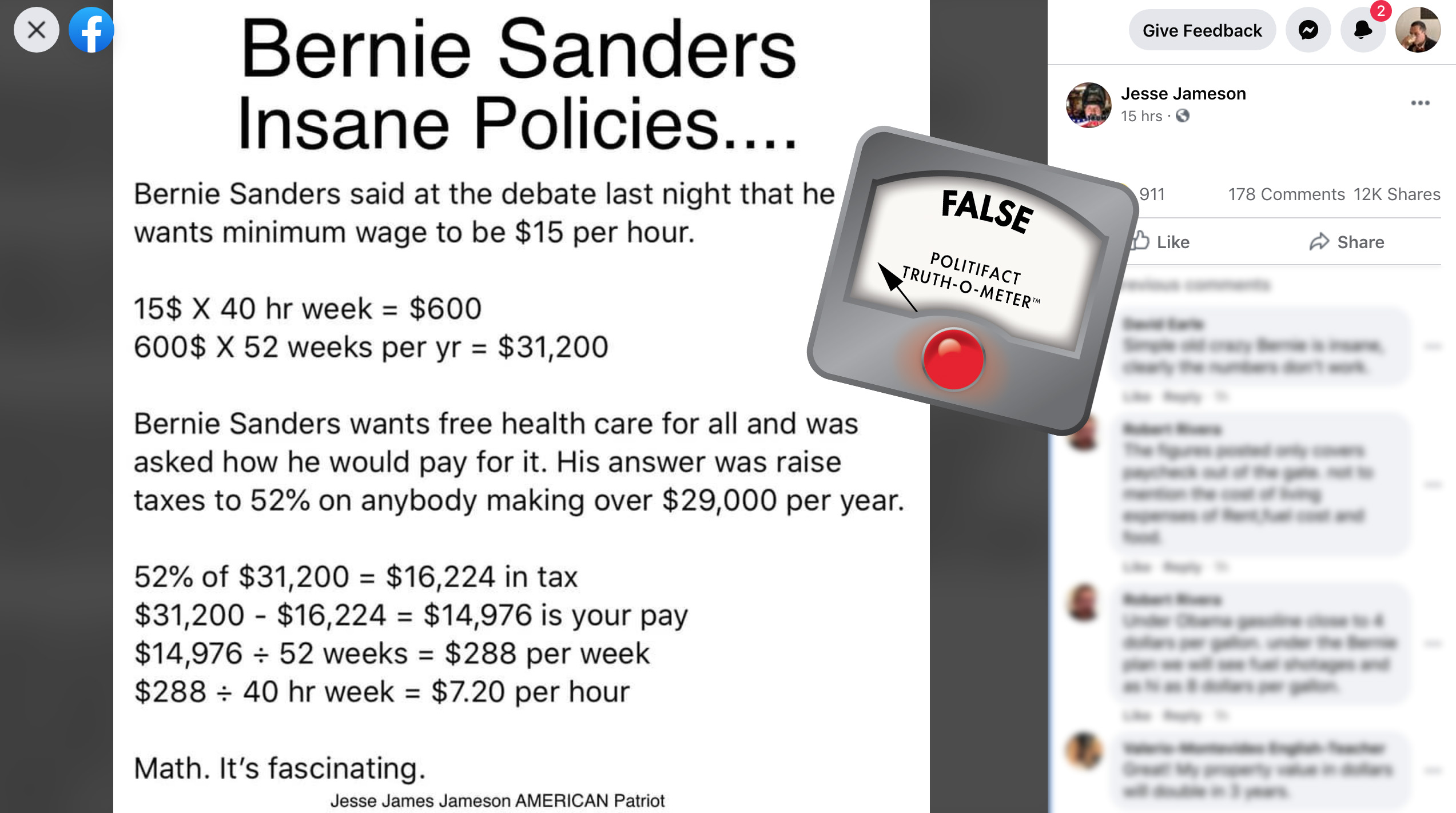

As an example if you make 15 per hour and are paid for working 40 hours per week for 52 weeks per year your annual salary pre-tax will be 15 40 52 31200. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week. Working 40 hours per week per year 52 Weeks full-time making 1450 an hour would earn 30160 per year before taxes as an annual salary.

His income will be. This result is found by multiplying 13 x 40 x 52 to get the final annual amount. You can usually expect to be paid time-and-half if you work over 40 hours a week.

So making 1400 per hour is equivalent to making 112 per day. In the Weekly hours field. See where that hard-earned money goes - Federal Income Tax Social Security and.

13 an hour is 27040 annually. Some jobs that typically have hourly salaries include home cleaners. In the year 2022 in New Zealand 14 an hour after-tax is 76284 annual 6357 monthly 1462 weekly 2924 daily and 3655 hourly gross income based on the most up-to-date tax year.

The current annual per employee maximum is 434. Also taxes can have a large impact on your salary. It depends on how many hours you work but assuming a 40 hour work week and working 50 weeks a year then a 14 hourly wage is about 28000 per year or 2333 a month.

To be considered full-time you must work. Its 01 001 on the first 7000 in wages that you pay to each employee. Most employers have to pay this tax.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. Some taxes are paid by the employee some by you and some are shared between you and your employee. How much money.

Standards Act hourly non-exempt. 14 an hour is 27300 per year. 14 an hour 38-40 hours a week.

Yearly Salary Chart for 1425hour by hoursweek and weeksyear.

After Tax Uk Salary Tax Calculator

Section 2 6 Pp Statement Of Earnings Ppt Download

Office Of The State Tax Sale Ombudsman

How Much Money Do The Top Income Earners Make By Percentage

Tax Hikes For Universal Health Care In California Calmatters

16 An Hour Is How Much A Year Can I Live On It Money Bliss

What Is Retroactive Pay And How To Calculate It Hourly Inc

The Social Insurance System In The Us Policies To Protect Workers And Families

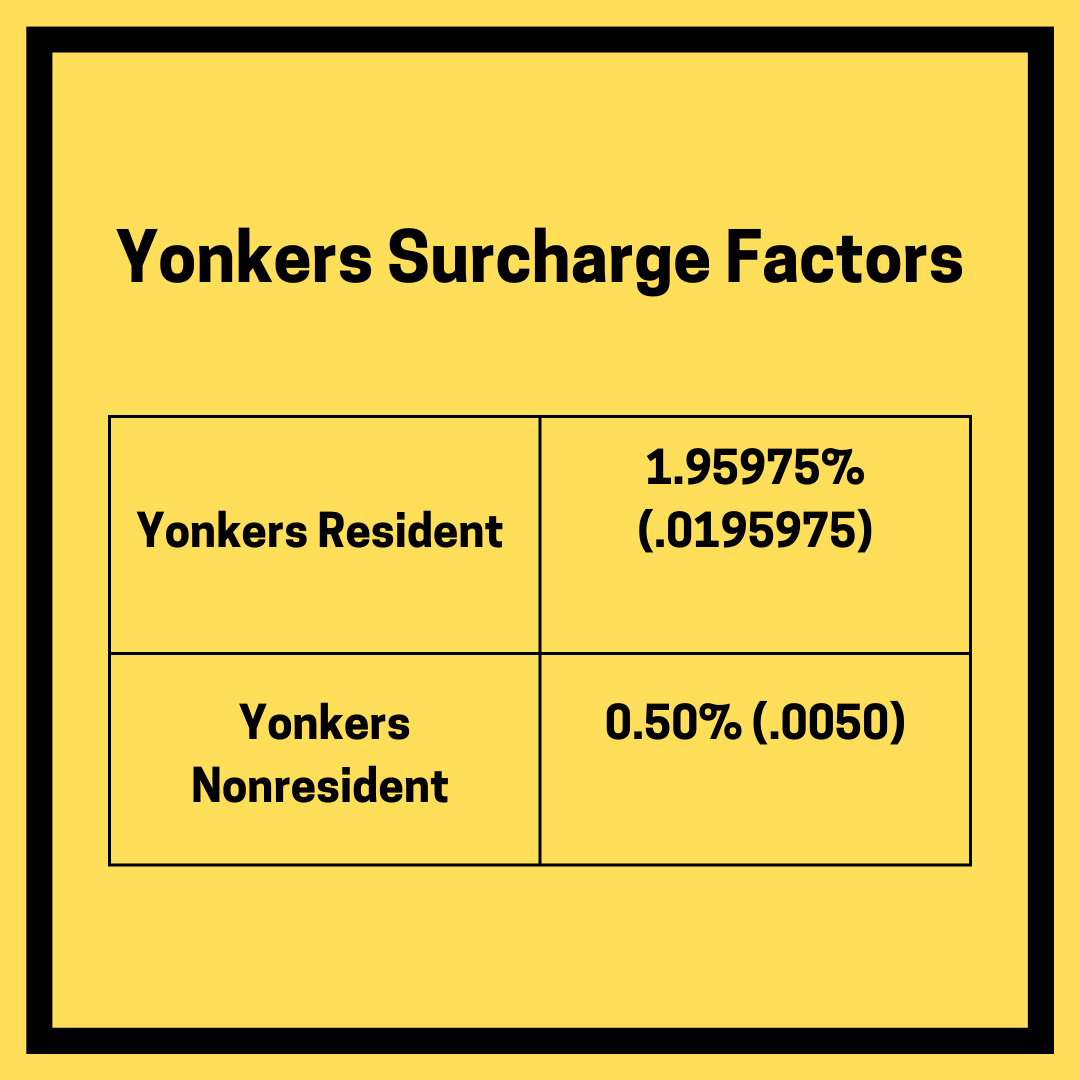

A Complete Guide To New York Payroll Taxes

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

I Make 15 An Hour I Work A 40 Hour Week How Much Do I Take Out For Taxes Since I M Self Employed Quora

Why Households Need 300 000 To Live A Middle Class Lifestyle

Where Tax Goes Up To 60 Per Cent And Everybody S Happy Paying It Tax The Guardian

טוויטר Daniel Ahmad בטוויטר Frankfirezzz Breenewsome Also The Half Of All Income Tax Thing Is False Https T Co 5u1s09lgr8

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

How To Read Your Pay Stub Paycheckcity

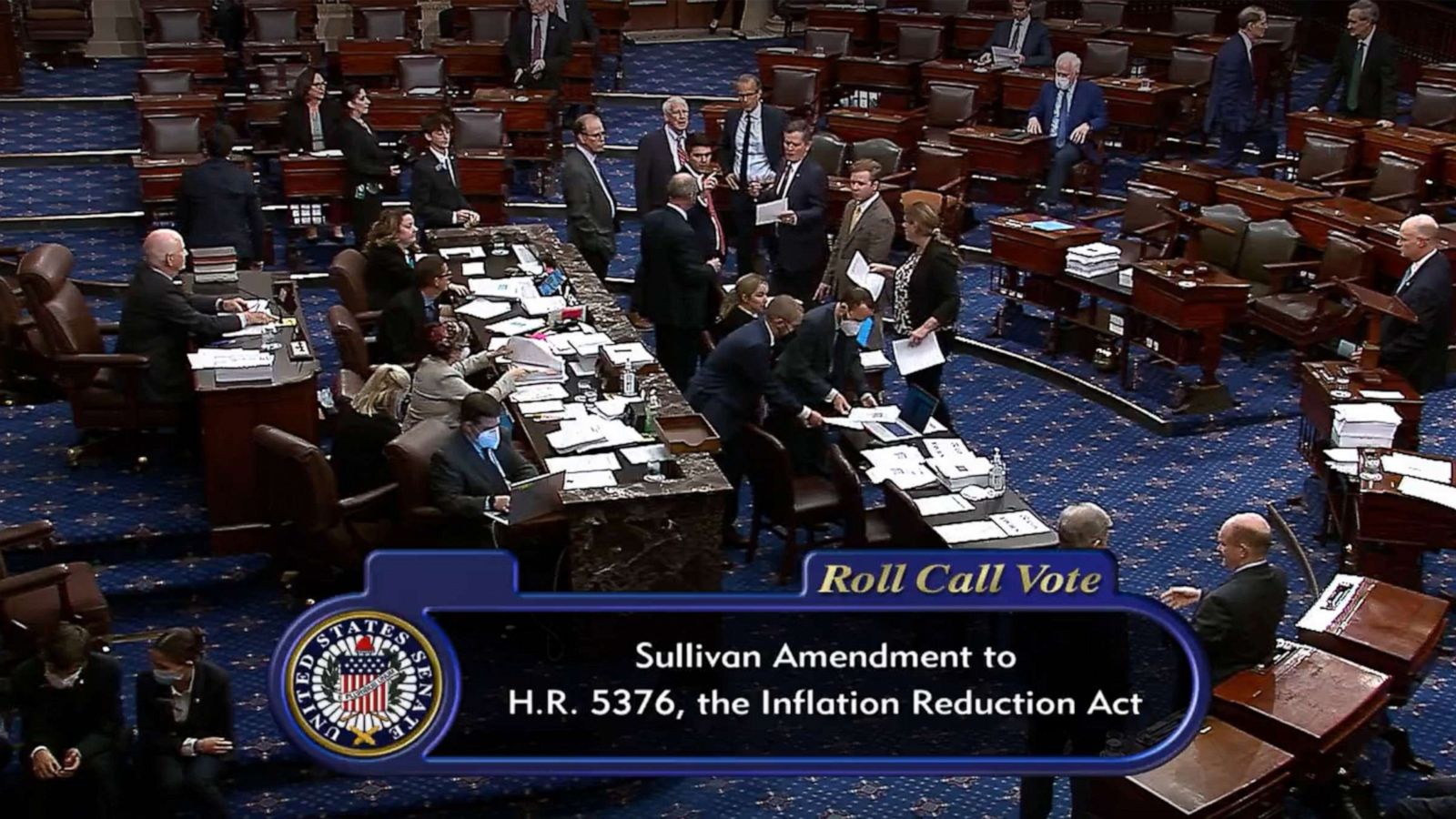

Senate Democrats Pass Climate Tax And Health Care Bill After Marathon Voting Session Abc News

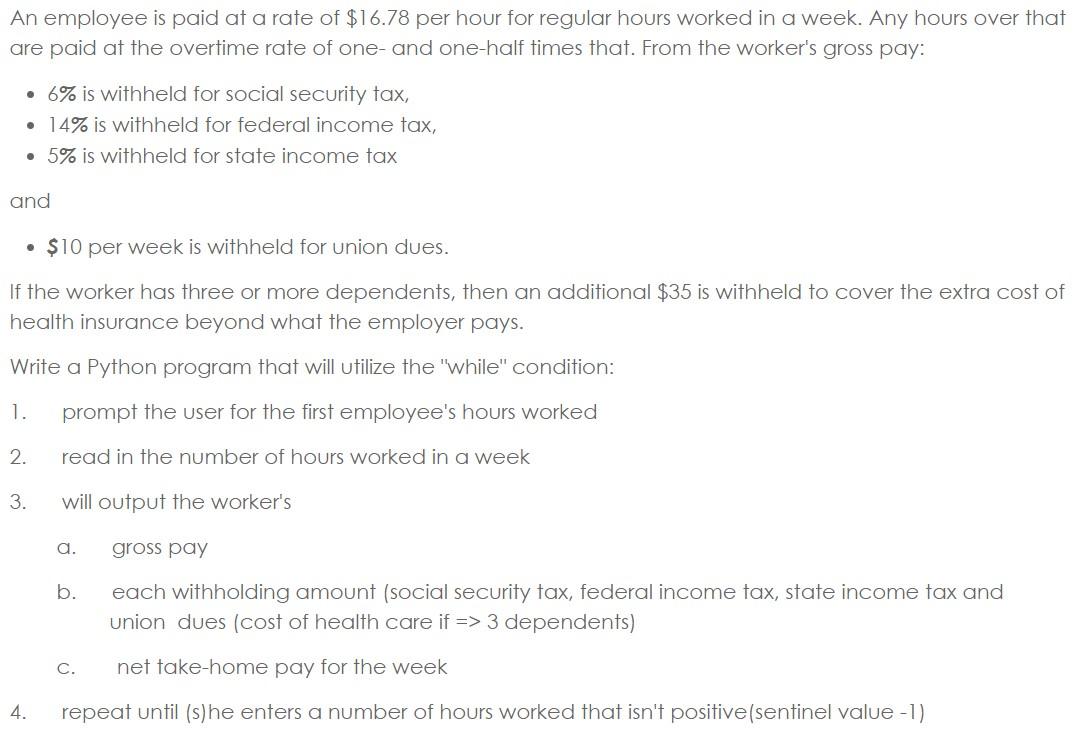

Solved An Employee Is Paid At A Rate Of 16 78 Per Hour For Chegg Com

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities