child tax credit portal

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. You may be able to claim the credit even if you dont normally file a tax return.

Child Tax Credit How To Update Your Direct Deposit And Address With The Irs Youtube

Our analysis ofthe Child Tax Credit.

. The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving. IMPORTANT INFORMATION - the following tax types are now available in myconneCT. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit.

Under a new law signed by President Biden on March 11 2021 individuals and families with children can get up to 300 per month per child under age 6. Visit ChildTaxCreditgov for details. If your refund is less than 1000 you.

The American Rescue Plan Act expanded the 2021 Child Tax Credit CTC to almost 90 of children in the US including families with no earned income who dont usually file tax returns. This section will help you identify Child Tax Credit payments you have received and tell the difference from other tax benefits. Parents can claim the benefits for up to three children.

The Child Tax Credit provides money to support American families helping them make ends meet more easily afford the costs of raising children or save for their childrens future. Receives 4500 in 6 monthly installments of 750 between. They can be forced to pay federal or state income taxes.

An online portal designed to help very low-income people get the expanded Child Tax Credit reopened Wednesday according to the nonprofit group that designed it in cooperation. Code for Americas new portal GetCTC will help families access the Child Tax Credit and other tax benefits they might have missed including stimulus payments. Apply for direct Catch Up Payments to get 200 to 250 to help pay for student learning supports to help fill gaps that may have emerged because of COVID19.

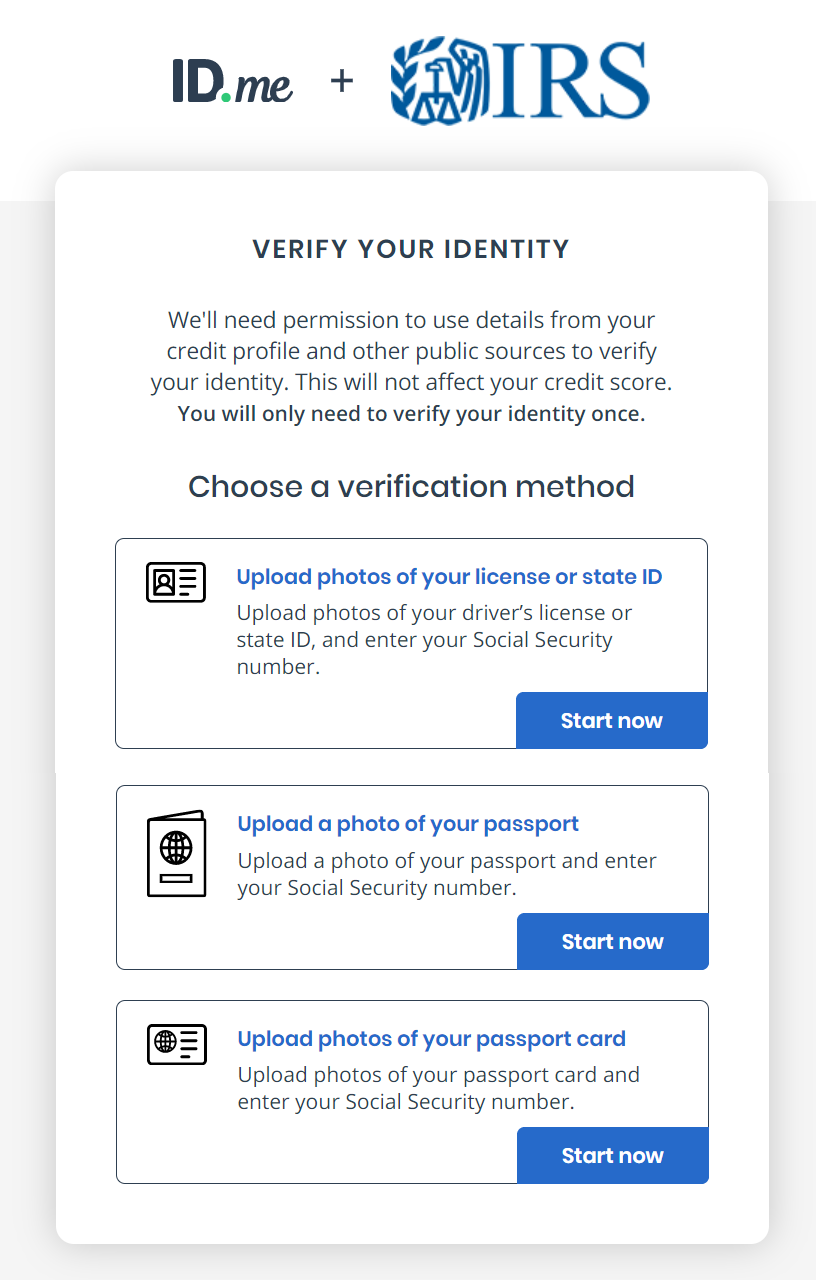

Department of Revenue Services. You can use the IRS Child Tax Credit Update Portal to view. Claim Child Benefit Universal Credit How and when your benefits are paid Tax credits if you leave or move to the UK Help if you have a disabled child Tax credits.

You can also use the tool to unenroll from receiving the monthly. June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file.

GetCTC makes it easy for. FAMILIES in Connecticut can apply for the states child tax credit and possibly receive up to 250 per child. The Child Tax Credit.

Can non filers get Child Tax Credit 2022. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The child tax credit was changed significantly in 2021 making it fully available for the first time to the lowest-income families including those who typically do not have to file a tax.

The child tax credits remaining balance may be taken from you if you are due a tax return in 2022. Individual Income Tax Attorney Occupational Tax Unified Gift and. Can I still receive that money now.

Added January 31 2022 A4. Total Child Tax Credit. The Child Tax Credit helps families with qualifying children get a tax break.

As a parent or. Increased to 9000 from 6000 thanks to the American Rescue Plan 3000 for each child over age 6. Your advance Child Tax Credit payments were based on the children you claimed for the Child Tax Credit on your 2020 tax return or 2019 tax return if your 2020 tax return had.

If youre eligible but did not receive any monthly advance Child Tax Credit.

Breaking News The Child Tax Credit Portal Is Open Your Money Line

Change Address On Child Tax Credit Update Portal Taxing Subjects

Child Tax Credits Latest Irs Launches New Tool For Families Receiving Paper Checks To Update Their Mailing Address The Us Sun

Child Tax Credit What We Do Community Advocates

Child Tax Credit Update A Portal To Update Bank Details And Facilitate Payments Marca

H R Block Update Your Income In The Child Tax Credit Update Portal By Nov 29 To Ensure You Re Getting The Correct Amount Of Advance Ctc Payments During 2021 You Can Access

How To Opt Out Of Advanced Child Tax Credit Payments And Why Some Accountants Advise It Wbma

Irs Child Tax Credit Portal How Can I Use It To Opt Out And What Other Uses Does It Have As Usa

Irs Child Tax Credit Portal Update Could Get You More Money Kare11 Com

Irs Child Tax Credit Portal Open For Parents Who Want To Opt Out Of The Monthly Payments 5newsonline Com

Child Tax Credit Update Portal Internal Revenue Service

Child Tax Credit Portal How To Update Your Income Details Before November 29 Marca

Biden Administration Relaunches Simplified Online Portal For Low Income Families To Claim Their Expanded Child Tax Credit

The Irs S Child Tax Credit Non Filer Portal Sucks For Low Income Americans

Update Child Tax Credit Portal Now If Your Income Changed Forbes Advisor

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back